New Jersey Food Tax Rate . Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. Our calculator is tailored to help you. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not.

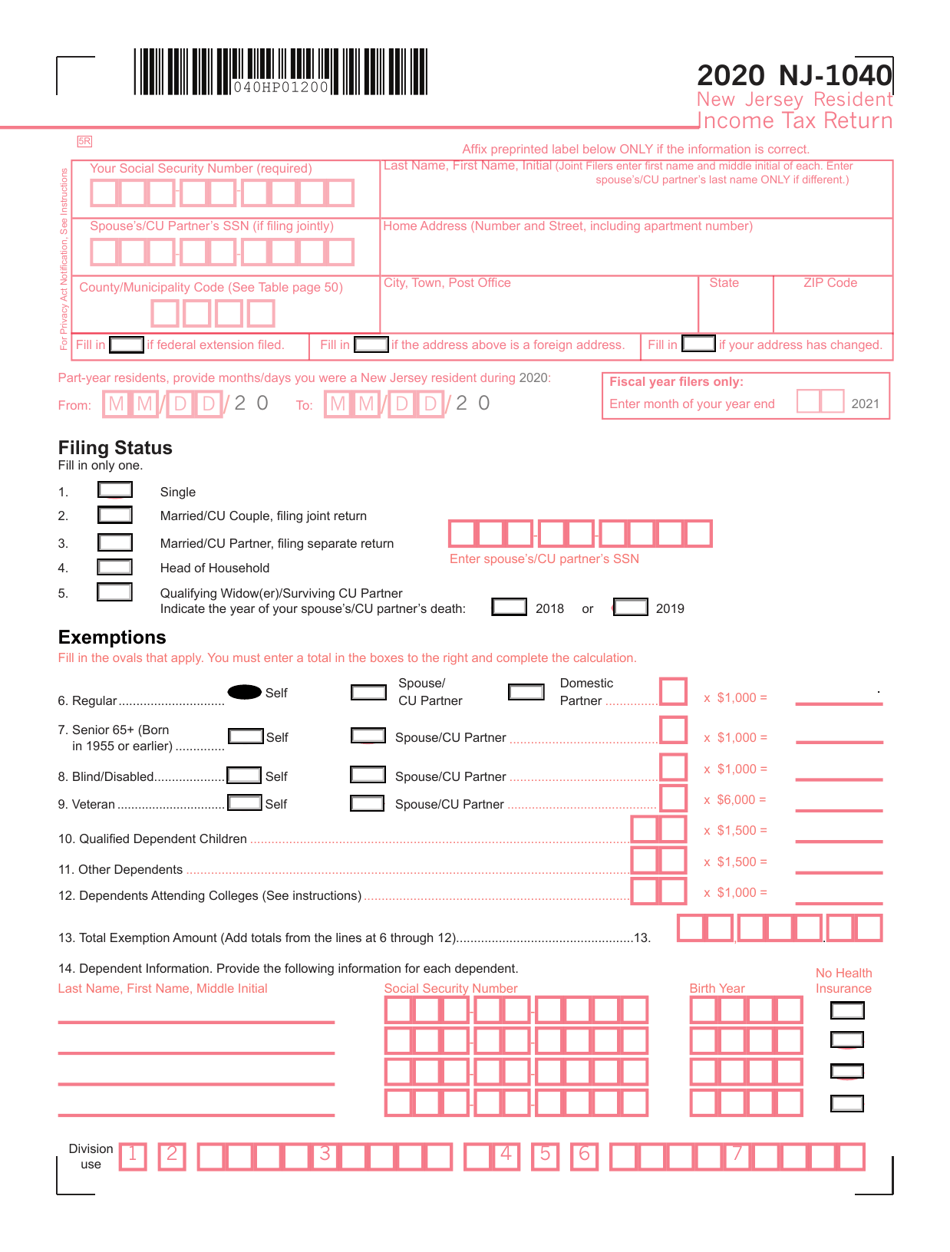

from www.templateroller.com

Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. Our calculator is tailored to help you. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not.

Form NJ1040 Download Fillable PDF or Fill Online New Jersey Resident

New Jersey Food Tax Rate The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. Our calculator is tailored to help you.

From vaseka.weebly.com

Federal tax brackets 2021 vs 2022 vaseka New Jersey Food Tax Rate The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain. New Jersey Food Tax Rate.

From www.youtube.com

New Jersey Food Stamp Limits for 2023 YouTube New Jersey Food Tax Rate Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. Our calculator is tailored to help you. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. The streamlined sales and use tax agreement affects the new jersey sales. New Jersey Food Tax Rate.

From taxpolicy.ird.govt.nz

2. The New Zealand tax system and how it compares internationally New Jersey Food Tax Rate Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not.. New Jersey Food Tax Rate.

From us.icalculator.info

New Jersey State Tax Tables 2023 US iCalculator™ New Jersey Food Tax Rate The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. In conclusion, there is indeed tax on food in new jersey, but the specific rules and. New Jersey Food Tax Rate.

From brokeasshome.com

nj tax table New Jersey Food Tax Rate Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. Our calculator is tailored to help you. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of. New Jersey Food Tax Rate.

From taxfoundation.org

New Jersey May Adopt Highest Corporate Tax in the Country New Jersey Food Tax Rate Our calculator is tailored to help you. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. Since 2018, new jersey has been. New Jersey Food Tax Rate.

From www.concordehotels.com.tr

jersey tax rate,OFF New Jersey Food Tax Rate In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. Our calculator is tailored to help you. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. Since 2018, new jersey has been. New Jersey Food Tax Rate.

From www.pinterest.com

The Ultimate Guide to the Best of New Jersey Food Jersey city, Jersey New Jersey Food Tax Rate While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. In conclusion, there is indeed tax on food in new jersey, but the specific rules and. New Jersey Food Tax Rate.

From taxpolicy.ird.govt.nz

2. The New Zealand tax system and how it compares internationally New Jersey Food Tax Rate Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when. New Jersey Food Tax Rate.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax New Jersey Food Tax Rate The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type. New Jersey Food Tax Rate.

From www.dreamstime.com

Food taxes stock photo. Image of colours, notes, finance 106751822 New Jersey Food Tax Rate The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. Since 2018, new jersey has been imposing sales taxes on restaurants at the. New Jersey Food Tax Rate.

From justonelap.com

Tax rates for the 2024 year of assessment Just One Lap New Jersey Food Tax Rate Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not.. New Jersey Food Tax Rate.

From www.themontclairgirl.com

12 Foods That Have Serious New Jersey History Montclair Girl New Jersey Food Tax Rate The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. Our calculator is tailored to help you. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. Since 2018, new jersey has been. New Jersey Food Tax Rate.

From travellemming.com

New Jersey Foods (A Local’s Guide to 16 Best NJ Dishes) New Jersey Food Tax Rate Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services,. New Jersey Food Tax Rate.

From davida.davivienda.com

7 25 Sales Tax Chart Printable Printable Word Searches New Jersey Food Tax Rate Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not.. New Jersey Food Tax Rate.

From sanjaytaxprozzz.blogspot.com

Nh Food Tax Rate New Jersey Food Tax Rate Our calculator is tailored to help you. The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. In conclusion, there is indeed tax on food in. New Jersey Food Tax Rate.

From taxedright.com

New Jersey State Taxes Taxed Right New Jersey Food Tax Rate While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. In conclusion, there is indeed tax on food in new jersey, but the specific rules and rates vary depending on the type of food purchase. Our calculator is tailored to help you. The streamlined sales and use tax. New Jersey Food Tax Rate.

From brokeasshome.com

Nj Tax Rate Table 2017 New Jersey Food Tax Rate The streamlined sales and use tax agreement affects the new jersey sales tax treatment of certain products and services, including, but not. While new jersey's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. Since 2018, new jersey has been imposing sales taxes on restaurants at the rate of 6.625%.. New Jersey Food Tax Rate.